In the recent past, India’s three major telecom operators – Reliance Jio, Bharti Airtel and Vodafone Idea have entered into high-stakes partnerships with prominent global network equipment vendors Nokia, Ericsson and Samsung.

- Why Network Expansion Deals Are Necessary for India’s Telecom Industry

- Background of the Bargain Deal

- Jio’s Positioning Strategy in Network Infrastructure

- Airtel’s Strategic Move Toward Premium Network Experience

- How These Deals Impact Vodafone Idea’s Comeback Strategy

- 5G and the Digital Ecosystem in India

- Future Outlook for Jio, Airtel, and Vodafone in India

- Potential Challenges Ahead

- Conclusion

The offers are major telecom gaming changers for the Indian market, enabling firms to access core network equipment at a cheaper cost. According to specialists within the sector, these deals are being signed at 30-40% below global rates, thus increasing the telecommunication infrastructure in India while easing the budget constraint.

Why Network Expansion Deals Are Necessary for India’s Telecom Industry

The telecommunication market in India thus ranks among the largest, with more than 1.2 billion unique subscribers. The need for faster data services and overall trends toward industry digitization have caused telecom operators to step up their efforts for network extension.

Nokia and Ericsson’s deals matter as Verizon’s deals because they allow telcos such as Jio, Airtel, Idea, BSNL, etc., to modernize their networks more economically, especially given the size of India and the population.

More critically, the deals provide telecom operators with an opportunity to purchase network equipment at such low costs. With high subscriber volumes and competition, the prices are reported to range from 30-40% lower than the global costs. This cost advantage enables telecom operators to deliver 4G and 5G coverage and network scale at fewer costs than other technologies.

Background of the Bargain Deal

The deep discounts that Jio, Airtel, and Vodafone get from their telecom equipment vendors are typical of Indian market conditions. Experts revealed that there is a good opportunity for vendors such as Nokia or Ericsson to offer aggressive pricing in areas such as India that boast a large and growing number of users and higher data consumption.

For global vendors, it has given them a chance to take a loss that was experienced in the recent past in other regions, including Europe and North America, where growth has slowed.

Key Points of the Deals with Nokia and Ericsson

The major points of the deals between Nokia, Ericsson and the interested parties are as follows:

- Reduced Equipment Costs: It came at the right time, given that telecom operators have been under pressure due to the liabilities incurred from 5G investments, and will let Jio, Airtel and Vodafone Idea have a 35-40 percent relief in the network equipment cost.

- Multi-Year Partnerships: Vodafone Idea has made a deal to buy equipment from Nokia, Ericsson, and Samsung worth $3.6 billion, which will enable the telecoms to upgrade their networks with better 4G and 5G coverage.

- Support for 5G Rollouts: Jio and Airtel have increased their current contracts to ensure that there is an adequate supply of equipment to meet the ever-increasing demand for 5G services in India. Jio’s Positioning Strategy in Network Infrastructure.

Jio’s Positioning Strategy in Network Infrastructure

5G was introduced by the country’s largest telecom player, Reliance Jio, which has positioned itself as a leader in the digitalization of India. It is financially sound, and that’s why it is in a position to negotiate favourable agreements with network vendors.

It currently cooperates with Ericsson and Nokia; of course, the company’s goal is to develop an innovative, effective, and cheap 5G network.

By aggressively launching 5G networks, It will increase internet penetration in other regions and can provide equal opportunities for digital services in rural areas, closing the gap between them. This growth matches up with the government’s Digital India initiative to make the country more connected.

Airtel’s Strategic Move Toward Premium Network Experience

The company that is slated to offer premium services also gets the best out of this strategic partnership. Such partnerships with Nokia and Ericsson are a step in Airtel’s strategy to expand the presence of the 4G network and increase the 5G connection implementation plan.

The company also wants to improve its average revenue per user (ARPU), and hence, it will convert feature phone users into smartphone users, along with offering features of advanced networks.

This is because expanding the networks is in line with the India Government’s Digital India, which requires Airtel to have a sound network. With this approach, Airtel has decided to contract Nokia, Ericsson, and Samsung to progress toward becoming the most crucial network provider in India.

How These Deals Impact Vodafone Idea’s Comeback Strategy

Vodafone Idea has been debt-ridden and has long faced competition from Jio and Airtel. Nevertheless, the most recent agreement with Nokia, Ericsson, and Samsung, worth $3.6 billion, is a significant step in the direction of Vi’s “VIL 2.0” strategy.

This long-term investment will help Vodafone Idea roll out 5G services at important places, which can increase the 4G population base and also lead to an increase in subscriber base.

These relations with Nokia and Ericsson began when Vodafone Idea was still in its formative stages. According to CEO Akshaya Moondra, they would enable the firm to add network coverage and regain lost subscribers.

The liberalization of the supply side, with Samsung as the new vendor for Vodafone Ide, aims to enhance the company’s range of services and the satisfaction of its consumers.

Why India’s Market Attracts Telecom Vendors Like Nokia and Ericsson

The growth prospects for the Indian market make it an ideal market for international network vendors. Both in Q1 and Q2 2024, Ericsson and Nokia digitally communicated that they experienced a decline in their revenues worldwide.

Yet, India emerged as a growth opportunity territory because of increased calls for digital services to support data needs. The War with these Telco Majors gives these vendors not only revenues but also an opportunity to trial and implement their next-generation contemporary solutions in one of the genuine telecom arenas globally.

5G and the Digital Ecosystem in India

As with other areas, Indian businesses are quickly embracing the future of 5G, with application possibilities for sectors including healthcare and education, as well as retail and logistics.

In Airtel, Vi or Jio and their network vendors’ agreements to advance this change, a key consideration is the availability and solidity of the networks for new applications such as IoT, Artificial Intelligence and big data analytics.

There is a growing need for faster data speeds. As stated in the report by Astute Analytica, the 5G market in India is expected to reach $7,065 million, from $1079.9 million in 2022 to $1,78,546.1 million by 2031.

Players such as Jio, through partnerships with Nokia, Ericsson, and Airtel and increased efforts to let feature phone users upgrade and embrace smartphones, show the extent to which telecom players are ready to fulfill this demand.

Future Outlook for Jio, Airtel, and Vodafone in India

The future is bright for both Jio, Airtel and Vodafone, but the future is not without its fair share of challenges. Here’s how each of the telecom giants is positioning itself:

- Jio: Jio might look at deepening its 5G expansion plans and possibly even turn to future advancement levels, 6G, for example. Its low-cost strategy with value equipment, such as Nokia and Ericsson in the telecommunication world, will put it at a vantage point in the future.

- Airtel: Airtel’s concentration on delivering services above the average could serve as a way to continually protect the market space. With this partnership, Airtel aims to offer its consumers the best network, holding strategic partnerships with Nokia and Ericsson.

- Vodafone Idea: With the financial losses troubling Vodafone for some time now, the relationships they have with Nokia, Ericsson, and Samsung could provide a means for revival. Vodafone needs to maintain value creation in fixed assets to stabilize its financial status and regain the market share capital.

Potential Challenges Ahead

While the above deals may look very optimistic to the telecom sector, some factors might affect the expansion of the networks. Here are a few:

- Increasing Equipment Import Duties: The Government of India has increased the BCD of printed circuit board assemblies used in telecommunication equipment from 10% to 15%. This increase puts pressure on vendors such as Nokia and Ericsson to meet these costs without burdening the telco.

- High Debt and Financial Constraints: The large amount of 5G investment, alongside Vodafone Idea’s high debt levels, means that all the companies involved are under financial pressure. This also limits the possible networks only by funding organs or inadequate provisions.

- Slow 5G Monetization: While 5G is rapidly growing, monetization is still in the early development stage. Players like Jio and Airtel are hopeful but not ecstatic, as most of the revenues from the 5G services may only kick in the future.

Conclusion

The agreements made between Jio, Airtel, and Vodafone with Nokia, Ericsson and Samsung shed light on how strategic alliances can bring change in India’s telecom industry. These agreements allow India’s primary telecom operators to obtain first-class network gear at much lower costs to prepare for vast 4G and 5G deployments throughout India.

For Jio, Airtel, and Vodafone, such deals are not only beneficial for increasing their services but also very important for sustaining themselves in the continuously growing market.

With these companies continuing to strengthen their networks, the Indian consumer is likely to await enhanced connection, faster connection speeds, and the push into the digital world.

By offering cheap 5G equipment, these telecommunication behemoths will have turned the wheel towards changing India digitally by providing internet connection at faster rates to millions of people in India.

Futures, Nokia, Ericsson, and Samsung are future relationships that will help determine the telecom frequency in India as Jio, Airtel, and Vodafone become one of the biggest 5G countries in the future. To read the analysis of telecom trends in India, please click here.

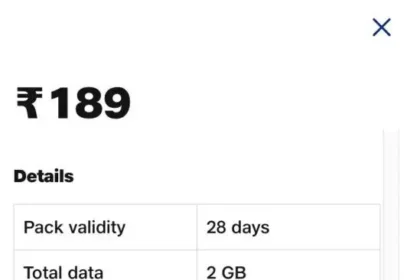

Visit the link here to learn about Jio recharge plans. It is essential to look into them regarding budget and data.