The much-anticipated IPO for another mega-company owned by Indian billionaire Mukesh Ambani, Reliance Jio, is now on the cards, with a tentative release slated for 2025.

- The Ambitious Journey Towards Reliance Jio IPO

- Reliance Jio’s Business Model

- Ambani’s Strategy: Delaying Reliance Retail’s IPO

- Key Investors and Strategic Partnerships

- What the IPO Means for India’s Stock Market

- Competitive Landscape: The Battle with Starlink

- Valuation and Market Impact

- Roadmap for Reliance Jio and Retail Unit

- Challenges Ahead

- Conclusion

The Jio IPO that has been in the making for quite some time now is tipped to be India’s biggest-ever Jio IPO, with investors placing the value of the telecom major at over $ 100 billion.

But for Reliance Retail, the path to going public could be a little longer, as Ambani is now in the process of building up strength and sorting out the issues from within. The following provides a breakdown of what investors, analysts, or stakeholders should anticipate regarding this major phenomenon in the Indian financial arena.

The Ambitious Journey Towards Reliance Jio IPO

Reliance Industries Chairman Mukesh Ambani said in the company’s annual general meeting in 2019 that both Reliance Jio and Reliance Retail will go public within the next five years.

Reliance Jio is ready to go public by 2025, and according to the analyst, it will be valued at more than $100 billion. The listing would not only be a landmark moment in Jio’s evolution but would also herald more growth in one of the world’s most dynamic telecoms markets.

Reliance Jio has expanded hugely since it was launched in December 2016. By the year 2023, the company had gained 479 million subscribers and became one of the biggest telecoms in the country.

This growth, which is supported by an investment of Ambani and strategic development, has enabled Reliance Jio to achieve reliable revenue status, which the company said is important before listing an Jio IPO.

Reliance Jio’s Business Model

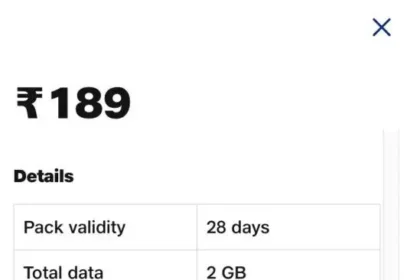

A stable business model is one of the main reasons Jio has positioned itself for an Jio IPO. A key factor has been the expansion of Reliance Jio, which, due to cheap data tariffs and the provision of various digital services, has made the company gain a large number of consumers and establish a fixed source of income.

Experts think that this stability explains why Reliance Jio’s value has been estimated to be over $100 billion in preparation for its Initial Public Offering, Jio IPO.

Currently, Ambani has been gearing up his telecom and digital companies, raising about $25 billion from global players, including KKR, General Atlantic, and the Abu Dhabi Investment Authority. This funding is a clear indication of the confidence investors have in Reliance’s growth prospects, and it has informed the company’s Jio IPO plans.

Ambani’s Strategy: Delaying Reliance Retail’s IPO

Even though Reliance Retail has also grown at the same pace, Ambani is not in a rush to list it alongside Jio. As informed by the insiders, Reliance does not wish to swamp the market with two large Jio IPOs at one time.

In addition, it was identified that there are a few internal issues in Reliance Retail, such as operational issues and profitability issues in some of the retail segments. There is, therefore, a need to address these issues if the retail unit is to grow and be sustainable.

Billionaire Mukesh Ambani’s company Reliance Retail has diversified into formats such as neighbourhood and online grocery stores and fashion and electronics outlets and has recently forayed into the e-commerce segment to take head-on Amazon and Walmart-owned Flipkart.

Nevertheless, this diversification posed some problems, such as some stores not being very efficient. Before going public, sources said that Ambani’s team is now aiming for operational efficiencies to ensure sustainable profitability.

Key Investors and Strategic Partnerships

Reliance Jio and Reliance Retail have been able to attract investment from some of the leading global players, including companies and private equity players.

Google and Meta have made many investments in Jio Platforms, which is now more of a parent company with telecom and digital as two distinct channels through which to expand Jio. These partnerships, along with Jio’s partnership with Nvidia for AI infrastructure next, have put Reliance Jio at the driver’s seat of digital India’s growth.

What the IPO Means for India’s Stock Market

Even if Jio successfully lists its Jio IPO, which is expected to be valued at more than $100 billion, it could surpass the largest Jio IPO in Indian automobile maker Hyundai India’s $330 million.

The expectation of the stock listing is likely to evoke much interest from both domestic and foreign investors, hence leading to increased stock market trading in India.

Indian markets have recently touched new highs, with 270 plus companies coming out with Jio IPOs, raising close to $ 12.58 billion by October. A large Jio IPO like Reliance Jio’s could even strengthen India’s potential as the biggest financial powerhouse.

Competitive Landscape: The Battle with Starlink

Currently, competition comes from both Indian and international players. However, Reliance Jio stands ready to challenge competition, especially in the global telecom operators.

Notably, the key competitor will be SpaceX’s Starlink, which Elon Musk intends to jio ipo launch in India shortly. If Starlink gains a foothold, Jio will have direct competition in the high-speed internet market, but local connectivity and partnerships would make it somewhat challenging for Starlink to contend in the space.

To remain relevant, Reliance Jio has predominantly relied on sophisticated technologies. With the support of Google and Meta, the company has agreed to form a partnership with Nvidia for AI development. This approach is useful in positioning Jio not only as a telecom company but also as a part of India’s digital value chain.

Valuation and Market Impact

Although Jio’s valuation has not been made official, Jefferies, an international investment bank, expected it to be around $112bn by the middle of July 2024. If Reliance Jio IPO succeeds and crosses this figure, it will not only establish Jio as the most successful telecom giant but also set a new record for Jio IPOs in India.

Another important aspect of Reliance Industries Ltd (RIL), the parent company of Jio, is also affected. An Jio IPO brings significant cash to RIL, which has been expanding its revenue streams recently. While oil and gas remain a major part of RIL’s operations, investment in telecom, retailing, and digital services makes the company a conglomerate.

Roadmap for Reliance Jio and Retail Unit

While Reliance Jio is planning to launch its Jio IPO in 2025 and the Retail IPO jio later, the succession in 2025 may indicate Ambani’s sequential growth plan rather than a simultaneous Jio IPO. This is perhaps to ensure that they target maximum market attention for each of the businesses and do not overcrowd the market with Jio IPOs.

Meanwhile, this has given Reliance Retail an opportunity to work on solving the challenges it has faced in its retail business. It has been improving e-commerce features, offering rapid grocery delivery, and shifting to fashion affiliations with Jimmy Choo, Marks & Spencer, and Pret A Manger.

As these enhancements continue, when Reliance Retail goes for an Jio IPO, it will have a better foundation and a more diverse revenue stream.

Challenges Ahead

Nevertheless, some challenges existed even after the Jio IPO of Reliance Jio. Bharti Airtel and Vodafone Idea are two of India’s telecom market players that continue to reign while battling for market dominance. Also, the success of the Starlink system could put new pressure on Jio to retain its subscribers and the quality of service.

However, Reliance Retail’s existing problem is to maximize profitability out of its 3,000 outlets. While the company has been on the right track, touching the sky in the Indian retail business, carving out a sustainable profit margin in such a different basket of retailing has been more challenging.

Conclusion

The Reliance Jio IPO is planned to be completed in 2025 as they adapt to the play and make Reliance Industries a digital and telecom behemoth on the world stage. Jio IPO will likely rank among the biggest ever seen in India and will step the company into the international playing field.

At the same time, though delayed, Ambani’s IPO plans for Reliance Retail reveal a highly deliberate and systematic approach to optimizing value for the shareholders. While Jio’s listing will attract attention, especially from investors and analysts, the same will happen for Reliance Retail.

As Ambani prepares to announce what the next big transformational period could be for his conglomerate, the Reliance Jio IPO provides a view into the future of business in India and how it can impact the world markets.

For more about Mukesh Ambani’s business and ventures, please read here. For more information related to Jio in India, go here.