Introduction

In a historic milestone that would redefine India’s mutual fund business, JioBlackRock, the 50:50 joint venture between Jio Financial Services (of the Reliance Group) and BlackRock, the world’s leading asset manager, has made its official entry into the Indian mutual fund market.

Jio’s digital penetration and financial infrastructure among India’s masses, with BlackRock’s worldwide asset management expertise, technology, and risk analytics. To bring investing to the masses in India by providing low-cost, technology-based mutual fund solutions—straight to customers.

And their entry has already made news.

Within a mere three days (June 30-July 2, 2025), JioBlackRock’s debut New Fund Offer (NFO) collected a staggering ₹17,800 crore-one of India’s biggest-ever openings for a new asset management firm. A total of over 67,000 retail investors and over 90 institutional participants joined in, reflecting stupendous trust and demand for the brand-new entrant.

This is not only a launch—it’s a wake-up call to legacy mutual fund houses. With its digital-first approach, ultra-low minimum investment barrier (only ₹500), and zero-commission distribution model, JioBlackRock is set to democratize mutual funds for crores of Indians—particularly in Tier 2 and Tier 3 cities.

Background

To appreciate the importance of JioBlackRock, we must first examine the two giants behind the initiative: Jio Financial Services and BlackRock.

Jio Financial Services is a relatively recent but aggressive spin-off of Reliance Industries Ltd., India’s largest conglomerate controlled by Mukesh Ambani. Initially a part of Reliance’s overall telecom and retail strategy, JFS was demerged and listed as an independent company in 2023.

JFS has a straightforward objective: to transform digital finance across India, just like Jio shook up the telecom sector in 2016. With access to:

- More than 475 million Jio subscribers,

- An 8 million+ network of Kirana partners under Reliance Retail and

- Increasing use of the JioFinance app,

- JFS is creating a digital-first ecosystem that provides lending, payments, insurance, and now investing.

- Expansion into mutual funds was a natural step towards becoming a full-spectrum digital financial services player.

BlackRock: The Global Giant in Asset Management

Established in 1988 in New York, BlackRock is the largest asset manager globally, managing more than $10 trillion in assets (as of 2024). It is a reputable name for institutional and retail investors based on:

- Low-cost index funds and ETFs such as iShares,

- Best-in-class risk management via its Aladdin platform,

- Leadership in ESG (Environmental, Social, Governance) investing,

- Global presence in 100+ countries.

In India, BlackRock once had a joint venture with DSP Group (DSP BlackRock) but left that in 2018. With the Indian mutual fund market growing fast—breaking past ₹50 lakh crore in AUM—BlackRock felt this was the ideal time to come back.

But now, they are looking for a partner who has enormous digital distribution muscle—step forward: Jio.

The Vision Behind the Partnership

In July 2023, BlackRock and JFS launched a 50:50 joint venture with an initial investment of $150 million (~₹1,200 crore) each. The concept was simple but potent:

- “Marriage BlackRock’s investment expertise globally with Jio’s digital infrastructure and India reach.”

- The firms plan to do together:

- Provide technology-enabled, low-cost investment solutions,

- Touch first-time investors in small towns via smartphones and

- Shake up traditional distribution patterns by eliminating intermediaries and brokers.

This alliance is greater than business—it’s a strategic partnership that marries financial inclusion with best-in-class portfolio management. For Jio, it’s about building its digital finance kingdom. For BlackRock, it’s about accessing India’s fast-expanding retail investor universe.

JioBlackRock is meant to be India’s Vanguard moment—making astute investing accessible to the average Indian.

The Big Launch

Once it had obtained regulatory approval in May 2025, JioBlackRock Mutual Fund debuted the market in a highly anticipated fashion on June 30, 2025, through the launch of its inaugural New Fund Offer (NFO). The offering comprised three low-risk debt fund schemes: the Jio BlackRock Liquid Fund, Money Market Fund, and Overnight Fund. They were particularly selected to attract both risk-averse first-time investors and giant institutions that wanted safe, short-term investments.

What came next was nothing less than phenomenal.

Within three days, from June 30 to July 2, the company mobilized a massive ₹17,800 crore (approximately $2.1 billion). This is among the most productive NFOs ever for a new mutual fund house in India. The launch had retail investor participation of over 67,000 and over 90 institutional investors, including corporate entities, financial institutions, and high-net-worth individuals.

A combination of factors made this such a resounding response. First and foremost, the minimum outlay was only ₹500, so the money was extremely accessible to ordinary Indians, including young professionals, gig economy workers, and students. The whole investment process was online, seamlessly embedded in the MyJio and JioFinance apps so that one could invest in a matter of clicks—no paperwork, no middlemen.

In addition, JioBlackRock provided only direct plans of mutual funds, eliminating broker commission costs and returning cost savings to investors. This is consistent with their ideals of building low-cost, transparent investments. Jio’s brand value and credibility, along with BlackRock’s international stature, lent the product an added layer of credibility that even experienced investors couldn’t overlook.

Rather than a placid, gradual beginning, JioBlackRock has burst onto the scene with figures even veterans would be jealous of. This is not merely another mutual fund launch—this is an indication that the Indian investment world is in the midst of a digital revolution, and JioBlackRock is taking the lead.

The Strategy: Digital-First, Low-Cost, High-Scale

JioBlackRock’s strategy for the mutual fund business isn’t one of launching new schemes but of revolutionizing the way Indians invest. At the center of it is a cutting-edge emphasis on digital delivery, affordability, and mass accessibility to reach tens of millions of first-time investors nationwide.

A Digital-First Experience

Unlike conventional mutual fund houses that heavily rely on third-party distributors and agents, JioBlackRock is taking a direct-to-investor approach. Investments can be made digitally through the MyJio app or the JioFinance app, which millions of Indians already use. The sign-up process is paperless, fast, and newbie-friendly — something that would surely attract tech-savvy customers who might never have seen the face of mutual funds.

With Jio’s telco and retail ecosystem, which includes 475 million-plus users and extensive digital reach across India, the venture has a strong distribution advantage that no other fund house currently possesses.

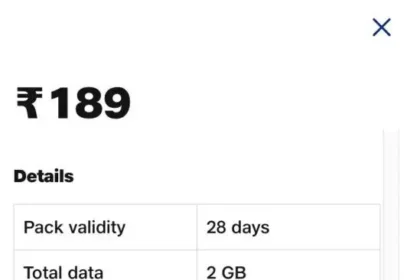

Ultra-Low Entry Barrier

JioBlackRock has slashed the minimum investment amount to just ₹500, a clear message that mutual funds aren’t just for the wealthy or financially literate elite. This move encourages students, gig workers, and rural investors to start their investments.

No Commissions, No Intermediaries

One of the most essential elements in the strategy is selling only direct plans. This avoids distributor commissions that generally take away from investor returns in regular plans. By eliminating the intermediaries, JioBlackRock is in a position to maintain low expense ratios and transfer more value to the investor directly.

This model not only saves money but also simplifies the investment process. Investors are in the know about where their money is being spent — and how much it’s costing them.

Tech-Powered Portfolio Management

What distinguishes JioBlackRock from domestic peers is its access to the Aladdin platform of BlackRock, a best-in-class portfolio and risk management system employed by leading institutional investors worldwide. This backend technology facilitates more effective fund management, risk analysis, and investor protection, even during turbulent markets.

JioBlackRock’s game plan is bold but uncomplicated: leverage technology to make investing easy, cost less and grow faster than incumbents. It’s not merely selling mutual funds — it’s attempting to create a new type of investor in India: assured, digital, and economically aware.

Upcoming Plans & New Fund Filings

Though JioBlackRock made its debut with debt funds and short-term funds, the company has just begun. In the background, it is working on a varied pipeline of mutual fund schemes intended to woo every type of investor — right from conservative savers to risk-taking equity players.

Equity, Hybrid & Index Funds in the Pipeline

Shortly after the overwhelming demand for its first three debt funds, JioBlackRock registered with SEBI to introduce eight new mutual fund schemes. They are:

- Equity funds – actively managed schemes that aim for long-term capital gains.

- Index funds – low-cost passive schemes replicating benchmark indices such as Nifty 50 or Sensex.

- Hybrid funds – combining equity and debt for balanced risk and return.

- The products are anticipated to be rolled out in phases during the second half of 2025, with the vision of presenting a full suite of investments to Indian investors by the end of the year.

Designed for the Masses

Staying true to its philosophy, JioBlackRock looks to make these new funds:

- Simple to comprehend – using plain language and use cases.

- Digitally accessible – merged into mobile platforms for easy investing.

- Affordable – with little or no entry costs and low expense ratios.

With the widening of its mutual fund franchise, JioBlackRock is setting itself up as a full-service AMC capable of competing in debt, in addition to equity and long-term wealth creation segments.

Reaching Bharat, Not Just India

What distinguishes this rollout is the aggressive move into Tier 2, Tier 3, and rural areas. Leveraging Jio’s telecommunication infrastructure and Reliance Retail’s massive local footprint, the firm aims to take mutual funds to towns and villages where financial products are regarded as intimidating or unaffordable.

This fits into the government’s larger agenda of deepening financial inclusion and getting more Indians to move their savings from gold and fixed deposits to market-linked investments.

In brief, JioBlackRock’s future fund launches are not simply about deepening its product offerings — they’re about deepening the very definition of what an investor can be in India.

Risks & Challenges

Although JioBlackRock’s entry into the mutual fund industry has been stunning, the journey ahead is not without its challenges. Shaking up an old and competitive industry like asset management takes more than money and a brand name — it takes sustained performance, building trust, and operational excellence.

- Performance Pressure

One of the most significant challenges for any new asset management firm is to provide consistent returns. Debt funds are stable, but the real test comes when JioBlackRock starts launching equity and hybrid funds, where volatility in the market plays a larger role. People will initially be drawn to the brand name, but retention will depend on long-term fund performance.

- Building Investor Trust

Even with powerful Reliance and BlackRock brand names, mutual fund investing rests on trust—particularly in India, where retail investors are still inexperienced with market-based instruments. Winning investor confidence, especially from first-time investors, will take:

- Clear communication,

- Quality customer service,

- Straightforward products,

- And delivering on promises consistently.

- Financial Literacy Gap

JioBlackRock’s endeavor to go to small towns and rural India is commendable, but financial literacy is poor in these parts of the country. Few potential investors are aware of the concepts of mutual funds, SIPs, or risk-return trade-offs. It will take time, effort, and resources to educate this huge segment — and it won’t be a matter of overnight success.

- Regulatory Oversight

SEBI closely governs India’s mutual fund business. As a digital-first entrant with a new brand, JioBlackRock will have to be very stringent in adhering to all regulatory standards, particularly in terms of:

- Investor protection,

- Data privacy,

- Advertisement guidelines,

- And fund disclosures.

- There cannot be any slip-up, as it would affect the brand credibility in the initial phases.

- Operational Scale and Servicing

With growth as fast and redemptions and onboarding so considerable, maintaining quality customer service at scale is quite an undertaking. From investor query handling to onboarding and redemptions handling, JioBlackRock will require a robust backend and tech support platform that can process large numbers without a hitch.

- Competitive Pushback

Existing players such as SBI Mutual Fund, HDFC MF, ICICI Prudential, and Axis MF already possess decades of experience, loyal customer bases, and countrywide distributor networks. Most are likely to react by lowering charges, enhancing service, or introducing tech innovations of their own — generating high-intensity price and performance warfare in the market.

JioBlackRock possesses the resources and ambition to reimagine mutual fund investing in India; it needs to overcome several obstacles — ranging from delivery of performance and investor education to regulatory intensity and scalability of services. How it succeeds in managing these risks will establish whether this early impetus is converted into sustained market leadership.

Conclusion

With its record-breaking launch and aggressive digital-first strategy, JioBlackRock has sent a clear message: it’s not here to play it safe — it’s here to change the face of how India invests.

By mashing up BlackRock’s global asset management capability with Jio’s enormous digital and retail reach, the joint venture is bringing to market an exciting new model — one of accessibility, affordability, and simplicity. Whether it’s the ₹500 minimum investment, app-based onboarding, or commission-free direct plans, JioBlackRock is reducing the entry barriers more than ever before.

The first ₹17,800 crore mobilized in a matter of three days is not merely a numbers game — it’s an indication that millions of Indians are eager for a different investment experience.

That being said, winning in the mutual fund space is a marathon, not a sprint. JioBlackRock will have to demonstrate its worth not only by being innovative but also by delivering solid fund performance, investor education, and good service over the long haul. It will also be competing against established giants who won’t relinquish market share without a fight.

But if it fulfills its potential, JioBlackRock may just set off a revolution — bringing mutual fund investing mainstream, digital, and firmly connected to Bharat rather than merely urban India.

In other words, this is not merely the introduction of a new fund house. It may be the dawn of India’s investing 2.0.

FAQ

- What is JioBlackRock Mutual Fund?

JioBlackRock is a 50:50 joint enterprise between Reliance’s Jio Financial Services and international investment behemoth BlackRock. It plans to introduce low-cost, technology-enabled mutual funds in India.

- Is JioBlackRock SEBI-registered?

Yes, JioBlackRock was approved by SEBI in May 2025 to be an Asset Management Company (AMC) in India.

- What type of mutual funds does it provide?

It has started with three debt funds — Liquid, Money Market, and Overnight. Additional equity, hybrid, and index funds will follow shortly.

- How do I invest in JioBlackRock funds?

Invest via the MyJio app or JioFinance app. The process is entirely online, and no paperwork is required.

- What is the minimum investment?

The minimum investment is as low as ₹500, making it easy for first-time and small investors to start.

- Are there any distributor or commission charges?

No. JioBlackRock has direct mutual fund plans only, with no commission or brokerage fees.

- Is it safe to invest with a new fund house?

Though the AMC is a new one, it’s being supported by reputed names — Jio (Reliance) and BlackRock — and overseen by SEBI. Nevertheless, investors must evaluate fund goals and risks before investing.

- Will JioBlackRock have SIP (Systematic Investment Plans)?

Yes, SIPs will be available in all future funds, with monthly regular investments.

- When will equity funds be available?

JioBlackRock has applied to launch equity and hybrid schemes and intends to roll them out in phases by late 2025.

- Where can I find additional information or view fund performance?

Go to the JioBlackRock website or view fund information and performance directly on the MyJio or JioFinance app.